Value of Ending Inventory Using Variable Costing

How many units remain in ending inventory. The post The value of ending inventory using.

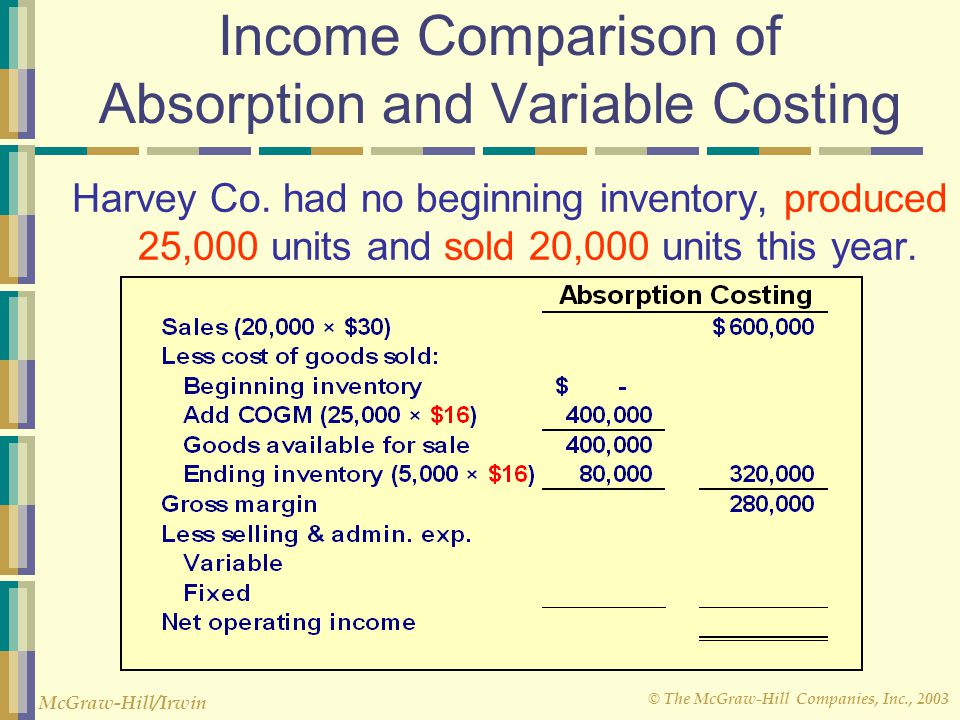

Variable Costing A Tool For Management 3 17 04 Ppt Download

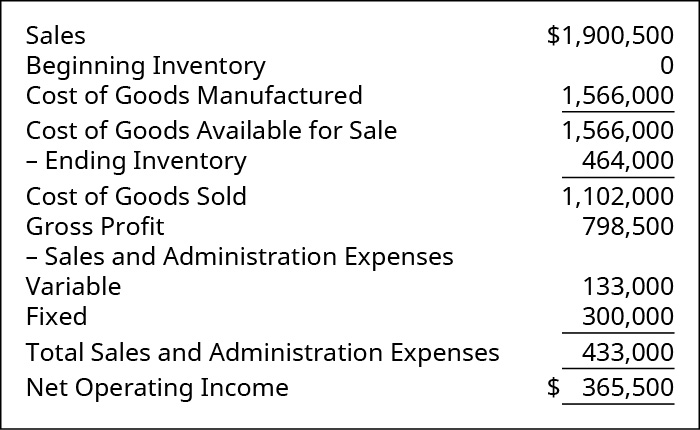

There is no beginning inventory.

. 5What is net income using full costing. Costs involved in production are. Direct materials 480 Direct labor 280 Variable overhead 140 Fixed overhead 680 Variable marketing cost 110 Fixed overhead per unit 326400 48000 units produced.

Variable Costing Value of Ending Inventory Operating Income Patfison Products Inc began operations in October and manufactured 49000 units during the month with the following unit costs. Fixed manufacturing overhead per year 155150. In May 2000 the company manufactured 20000 caps.

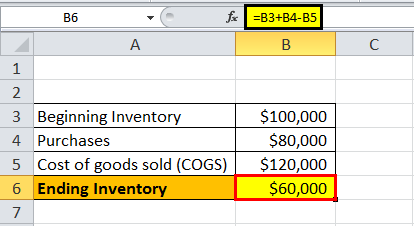

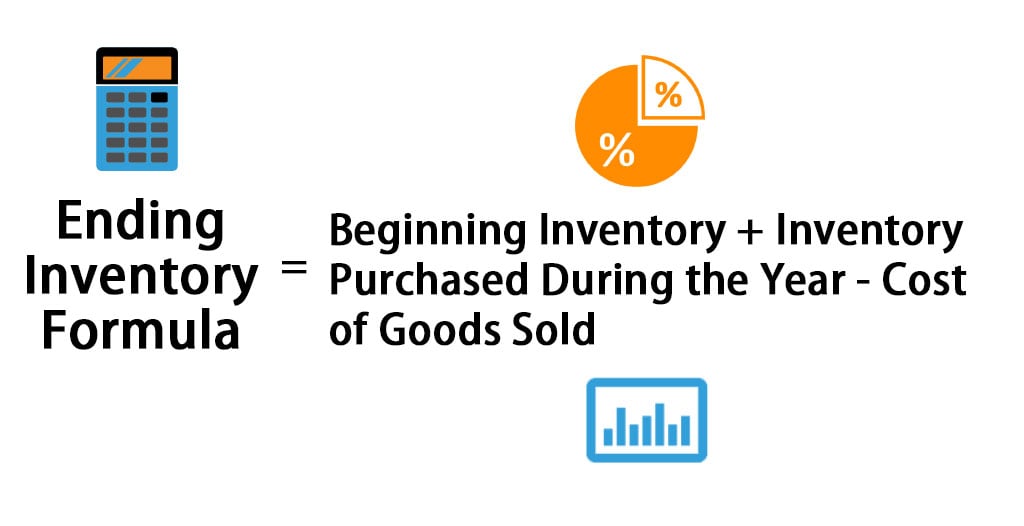

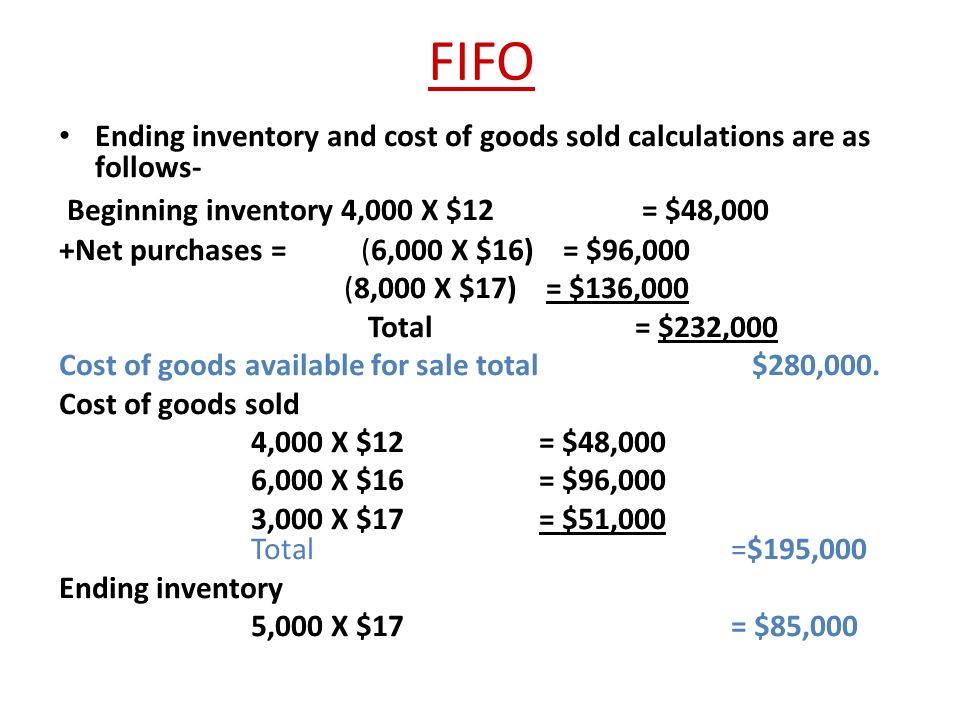

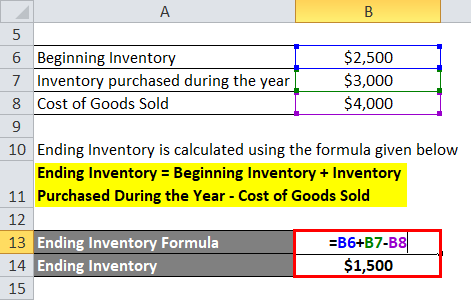

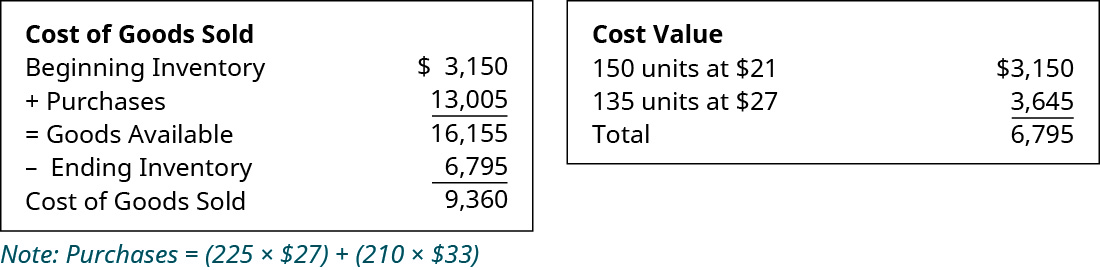

Variable manufacturing overhead 400 Total variable manufacturing costs per unit 1400 Fixed manufacturing overhead per year 166650 In addition the company has fixed selling and administrative costs of 161100 per year The post The value of ending inventory using full costing first appeared on. Beginning Inventory Purchases - Ending Inventory COGS 4 Steps to Calculate COGS Diving a level deeper into t. Heres the general formula for calculating cost of goods sold.

Costs involved in production are. What is the value of ending inventory using variable costing. After dividing 20000 into 60000 your inventory turnover ratio is three.

What is the cost of ending inventory using variable costing3. Question Costs involved in production are. Variable Costing Value of Ending Inventory Operating IncomeRefer to Cornerstone Exercise 183Required1.

Variable Costing Value of Ending Inventory Operating Income Pattison Products Inc began operations in October and manufactured 44000 units during the month with the following unit costs. Clinton Manufacturing produces snow shovels. 2What is the value of ending inventory using variable costing.

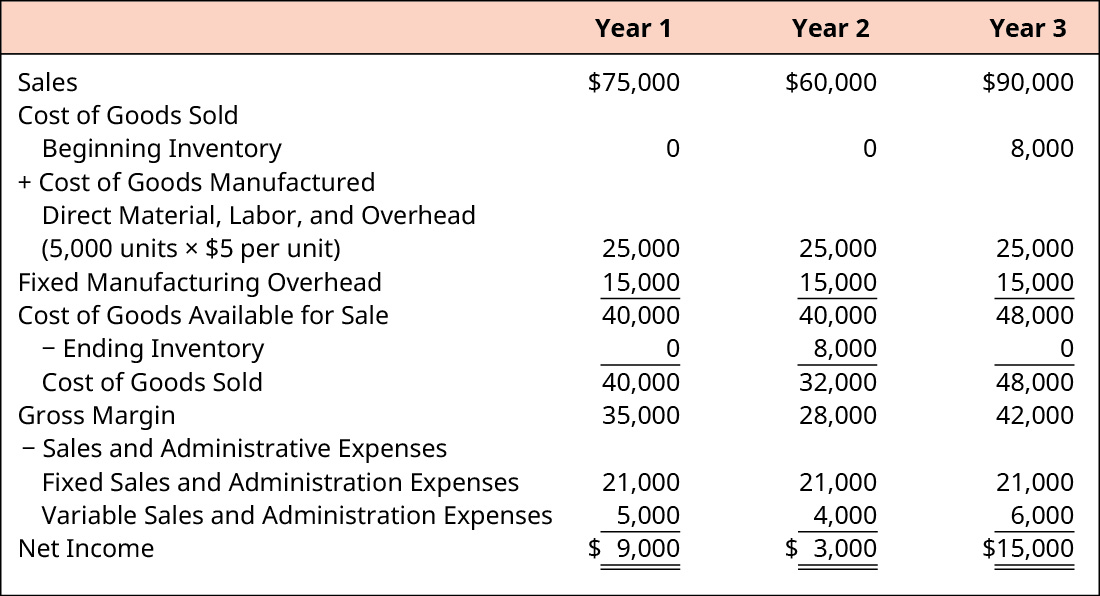

What is the value of ending inventory using variable costing Answered. 3What is the cost of goods sold using full costing. Calculate profit and the value of ending inventory for each year using variable costing.

Direct materials 550 Direct labor 350 Variable overhead 175 Fixed overhead 750 Variable marketing cost 145 Fixed overhead per unit 345000 46000 units produced. There is no beginning inventory. The selling price per snow shovel is 3100.

Costs involved in production are. Explain why profit fluctuates from year to year even though the number of units sold the selling price and the cost structure remain constant. 4What is the cost of goods sold using variable costing.

Under variable costing only the costs that change based on production are included in the cost of inventory. The selling price per snow shovel is 3100. What is the value of the ending inventory using the variable costing method.

There is no beginning inventory. Variable Costing Value of Ending Inventory Operating Income Pattison Products Inc began operations in October and manufactured 49000 units during the month with the following unit costs. Calculate profit and the value of ending inventory for each year using full costing.

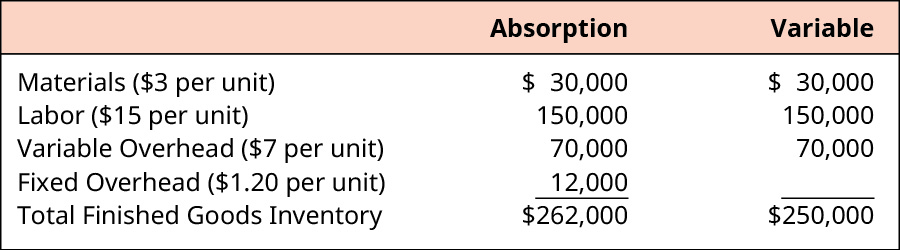

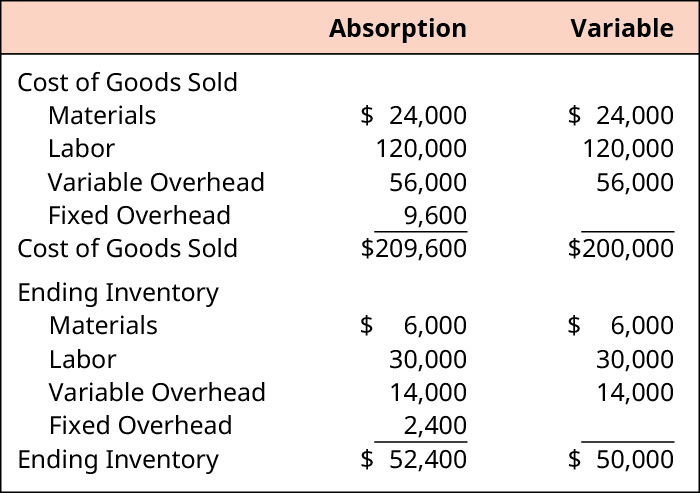

Absorption Costing Value of Ending Inventory Operating Income Pattison Products Inc began operations in October and manufactured 49000 units during the month with the following unit costs. Absorption Costing versus Variable Costing There are 2000 units in ending inventory. 4What is the cost of goods sold using variable costing.

Costs involved in production are. 2What is the value of ending inventory using variable costing. Inventory values calculated using variable costing as opposed to absorption costing will generally be a.

May sales were 18400 caps. There is no beginning inventory. Ending inventory using absorption costing 9 x 2000 18000 Ending inventory using variable costing 7 x 2000 14000.

4What is the cost of goods sold using variable costing. Variable Costing Value of Ending Inventory Operating Income Pattison Products Inc began operations in October and manufactured 46000 units during the month with the following unit costs. 5What is net income using full costing.

The variable costs associated with inventory are usually direct labor direct materials. See the answer Show transcribed image text Expert Answer 100 2 ratings a Value of ending inventory using absorption costing 402010306000 6. Direct materials 460 Direct labor 260 Variable overhead 130 Fixed overhead 660 Variable marketing cost 100 Fixed overhead per unit 323400 3 49000 units produced.

According to your annual financial statements and accounting records your cost of goods sold is 60000 and the ending inventory is 20000. Direct material 500 Direct labor 400 Variable manufacturing overhead 400 Total variable manufacturing costs per unit 1300 Fixed manufacturing overhead per year 177840 In addition the company has fixed selling and administrative costs of 172200 per year. The selling price per snow shovel is 3100.

3What is the cost of goods sold using full costing. Prepare a variable-costing income statement for Pattison. That it assigns only manufacturing costs to the product.

Calculate the cost of each unit using variable costing2. Clinton Manufacturing produces snow shovels. Solutions for Chapter 18 Problem 4CE.

That it is not a useful format for decision making. Variable manufacturing overhead 400. The number of units is multiplied by unit cost to calculate the dollar value of the ending inventory.

View the full answer. What is the value of ending inventory using variable costing. A disadvantage of absorption costing is a.

Clinton Manufacturing produces snow shovels. Fixed overhead per unit 343000 49000 units produced 700 Total fixed factory overhead is 343000 per month. Direct materials 500 Direct labor 300 Variable overhead 150 Fixed overhead 700 Variable marketing cost 120 Fixed overhead per unit 343000 49000 units produced 7.

The cost per unit for the 20000. 5What is net income using full costing. This means your inventory has been sold or turned over three times.

Variable Costing Value of Ending Inventory Operating Income Pattison Products Inc began operations in October and manufactured 48000 units during the month with the following unit costs. Total variable manufacturing costs per unit 1400. Direct materials 580 Direct labor 380 Variable overhead 190 Fixed overhead 780 Variable marketing cost 160 Fixed overhead per unit 343200 44000 units produced.

This problem has been solved. This provides the final value of the inventory at the end of the accounting period. Variable costing Harvard Hats Company produces baseball caps.

Variable manufacturing overhead 400.

Ending Inventory Formula Step By Step Calculation Examples

Ending Inventory Formula Calculator Excel Template

Compare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting

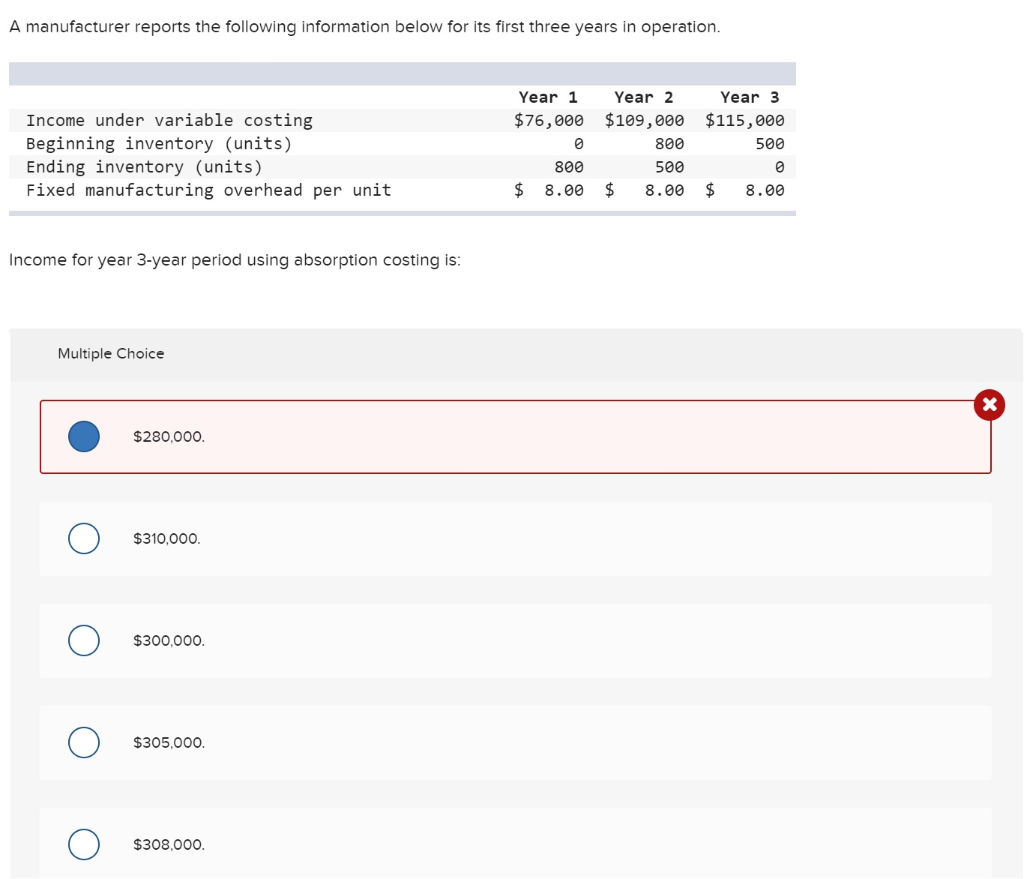

Solved A Manufacturer Reports The Following Information Chegg Com

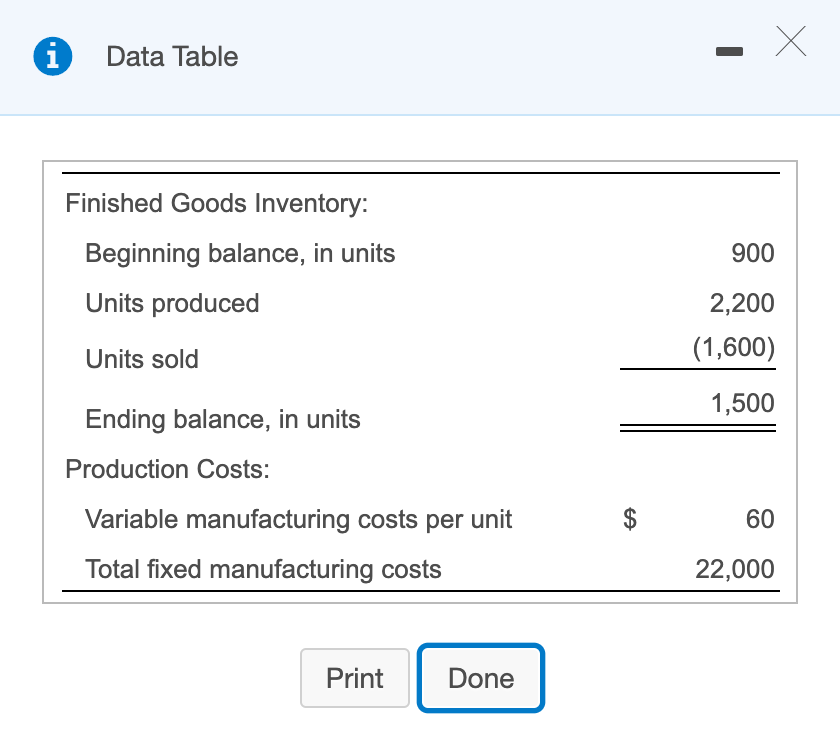

Solved Calculate The Product Cost Per Unit And The Total Chegg Com

Solved Calculate The Product Cost Per Unit And The Total Chegg Com

Ending Inventory Formula Step By Step Calculation Examples

Absorption Costing And Variable Costing Ppt Download

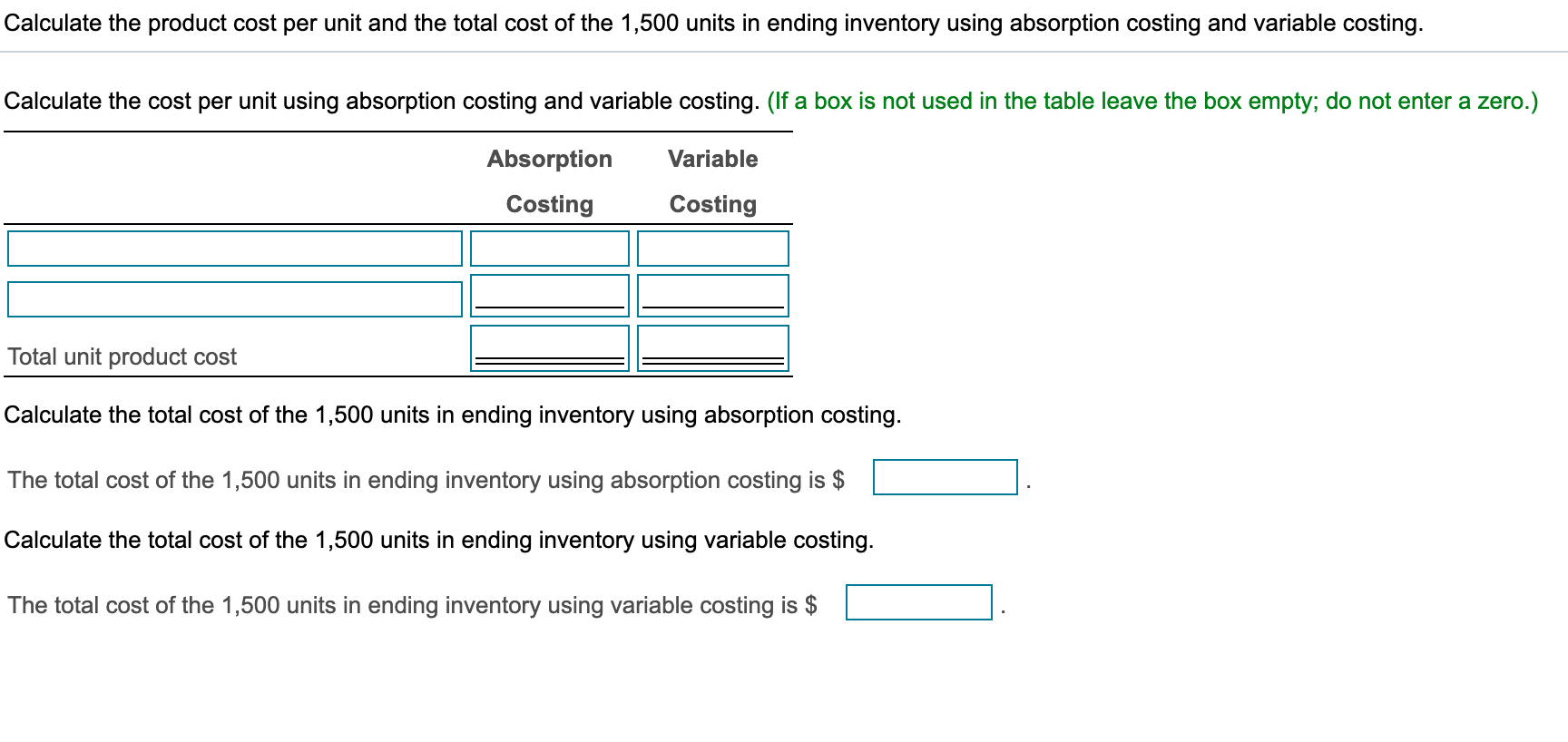

Variable Versus Absorption Costing Principlesofaccounting Com

Using Variable Costing To Make Decisions Accounting For Managers

Solved Requirements What Is The Ending Finished Goods Chegg Com

How To Calculate Ending Inventory Using Absorption Costing Online Accounting

Compare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting

Solved Problem 5 2 Part Level Submission Hamilton Stage Chegg Com

Ending Inventory Formula Calculator Excel Template

Compare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting

Compare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Chapter 3 Absorption And Variable Costing Ending Inventory Valuation Youtube

Comments

Post a Comment